On May 3, 2023, the monthly metal index of rare earths reflected a significant decline; Last month, most components of the AGmetalminer rare earth index showed a decline; The new project may increase the downward pressure on rare earth prices.

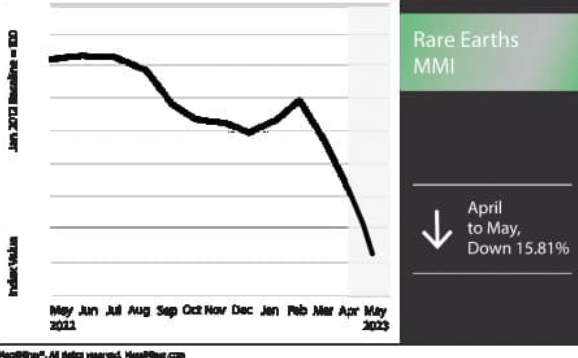

The rare earth MMI (monthly metal index) experienced another significant month on month decline. Overall, the index fell by 15.81%. The significant decline in these prices is caused by various factors. One of the biggest culprits is an increase in supply and a decrease in demand. Due to the emergence of new mining plans worldwide, the prices of rare earth metals have also decreased. Although some parts of the Metal Miner rare earth index are sideways organized on a monthly basis, most component stocks have fallen, driving the overall index to decline significantly.

China is considering banning the export of certain rare earth elements

China may ban the export of certain rare earth elements. This move aims to protect China’s high-tech advantages, but may have significant economic impacts on the United States and Japan. China’s dominant position in the rare earth market has always been a concern for many countries that still rely on China to convert rare earth raw materials into usable final products. Therefore, China’s ban or restriction on rare earth element exports may have a significant impact on the global supply chain.

Nevertheless, some experts believe that the threat of China ceasing exports of rare minerals may not give Beijing too much advantage in the ongoing trade conflict between China and the United States. In fact, they believe that this move may reduce finished product exports, thereby harming China’s own economy.

Possible positive and negative impacts of China’s export ban

It is estimated that China’s export ban plan may be completed by the end of 2023. According to data from the United States Geological Survey, China produces slightly more than two-thirds of the world’s rare earth metals. Its mineral reserves are also twice that of the following countries. Due to China supplying 80% of rare earth imports from the United States, this ban may be detrimental to some American companies.

Despite these negative impacts, some people still interpret this as a blessing in disguise. After all, the world is continuing to search for alternatives to China’s rare earth supply to reduce dependence on this Asian country. If China wants to push for a ban, the world will have no choice but to find new sources and trade partnerships.

With the emergence of new rare earth mining projects, the supply has increased

Due to the increasing number of new rare earth element mining plans, China’s measures may not be as effective as hoped. In fact, supply began to increase, and demand decreased accordingly. As a result, short-term element prices have not found much bullish force. However, there is still a glimmer of hope as these new measures will prevent dependence on China and help shape a new global rare earth supply chain.

For example, the US Department of Defense recently provided a $35 million grant to MP Materials to establish new rare earth processing facilities. This recognition is part of the Ministry of Defense’s efforts to strengthen local mining and distribution while reducing dependence on China. In addition, the Department of Defense and MP Materials have been collaborating on other projects to improve the rare earth supply chain in the United States. These measures will greatly enhance the competitiveness of the United States in the global clean energy market.

The International Energy Agency (IEA) also drew attention to how rare earths will affect the “Green Revolution”. According to a study by the International Energy Agency on the importance of key minerals in the transition to clean energy, the total amount of minerals required for renewable energy technology globally will double by 2040.

Rare Earth MMI: Significant Price Changes

The price of praseodymium neodymium oxide has dropped significantly by 16.07% to $62830.40 per metric ton.

The price of neodymium oxide in China plummeted by 18.3% to $66427.91 per metric ton.

Cerium oxide decreased significantly by 15.45% month on month. The current price is $799.57 per metric ton.

Finally, dysprosium oxide fell by 8.88%, bringing the price to $274.43 per kilogram.

Post time: May-05-2023